By Andrew Ross

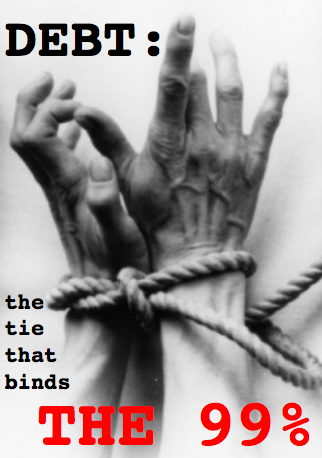

Every other day brings us fresh headlines about malfeasance, fraud and continued predatory behavior on the part of the finance industry. Morally speaking, bankers are the most depraved and derelict actors in our society. And yet they continue to rely upon heavy-duty moralism to enforce debtors’ obligations. What is an appropriate response? Here are nine arguments to justify repudiating debts as an act of economic disobedience. Appealing to basic moral principles, they are fleshed out in much more detail in Creditocracy and the Case for Debt Refusal. The list is far from exhaustive, but it is a start, and I invite you to add others. The goal? To determine which of our debts should be honored, and which should not.

- Loans which either benefit the creditor only, or inflict social and environmental damage on individuals, families, and communities, should be renegotiated to compensate for harms.

- Lending to borrowers who cannot repay is unscrupulous, and so the collection of such debts should not be honored. Making loans that clearly can never be repaid in full is a more delinquent act than being unable to pay.

- The banks, and their beneficiaries, awash in bonuses, profits, and dividends, have done very well; they have been paid enough already, and do not need to be additionally reimbursed. Since the creditor class produces phony wealth, fake growth, and thus no lasting prosperity to society as a whole, it deserves nothing from us in return.

- The credit was not theirs to begin with–most of it was obtained through the dubious power of money creation, thanks to fractional reserve banking and the “magic” of derivatives. The right to claim unearned income from debts created so easily should not be recognized as binding.

- Even if household debts were not intentionally imposed as political constraints, they unavoidably stifle our capacity to think freely, act conscientiously, and fulfill our democratic responsibilities. Economic disobedience is justified as a protective deed on behalf of democracy. Indeed, asserting the moral right to repudiate debt may be the only way of rebuilding popular democracy.

- Extracting long-term profits from our short-term need to access subsistence resources or vital common goods like education, healthcare, and public infrastructure is usurious, anti-social conduct, to be condemned (or outlawed) and not indemnified.

- Each act of debt service should be regarded as a nonproductive addition to the banks’ balance sheets and a subtraction from the “real” economy which creates jobs, adequately funds social spending, and sustains the well-being of communities.

- Obliging debtors to forfeit future income is a form of wage theft, and, if the debts were incurred simply to prepare ourselves, in mind and body, for employment, they should be resisted. This applies especially to education debt.

- Given the fraud and deceit practiced by bankers, and the likelihood that they will not refrain from such anti-social conduct in the future, it would be morally hazardous of us to reward them any further. The finance industry relies on moralism to enforce repayment, but who is the real “delinquent”? It is more moral to deny them than to pay them back.